Palantir (NYSE: PLTR) Earnings Call Q3 2022

CEO Alex Karp

When you build software products, you try to build them based on the way the world is and the way to transform the world into a better place. And I don’t think that’s optimism or pessimism. I think that’s trans reformism. That’s how do we take the business and move it from here to here in a very short period of time.

By the way, time, take the timelines, cut them in half, or divide them by. And like you want transformation goals that fail, but at a high level. So it’s like, oh, you need two years to this. Great. I want to see it done in two months. This, this will surface all the problems. And uh, you see one of the regions special operators are special operators is because the timelines are tight, the budgets are actually thinner.

You know, special operations communities operate with less. And less time and more constraints and then compare the output. Once we implemented pushing recommendations to the field staff, we dropped 20% At this particular site. It’s a small plant, 20%, still $300,000 in our budget. That’s direct money for us, so this is tremendous generated a lot of interest in the companies you can imagine, because we have 300 sites, you can do the math.

Our value here is that we’ve had about 20 different projects. We’ve created over 200 million in. Savings. That’s a big deal, right? This has all been two years. That’s hard to beat. That’s really hard to beat. The time to analyze. We basically drastically reduce that time factor Six, faster learning. We could fly more often, we could learn faster.

Is this fearlessness about data? We all often talk ourselves out of things in terms of why we can’t deliver this, why it’s gonna take too long, why it’s prohibitive. But Palantir brought. I would say a refreshing fearlessness to that part of the discussion about a third of the company is now active user of the Foundry.

We started with use cases like a real problem that has a huge impact on the company and, and we had several very good successes together with Palantier. And one of the things that I’m very personally proud of and um, part of the team, there are 15,000 souls that would not have been able to be evacuated unless we had had that found.

I’ll now turn the call over to Ryan. We generated 478 million in revenue this past quarter and 37 million in adjusted free cash flow marking our eighth consecutive quarter of positive adjusted free cash flow. Despite significant geopolitical and macroeconomic uncertainty, our government business surpassed the 1 billion revenue mark on a trailing 12 month basis.

And our US commercial business grew for the ninth quarter in a row rising 53% year over year. The number of customers using our software, including leading commercial and government enterprises in the US and overseas also increased substantially this past quarter rising 66% from this time last. , we increased our US commercial customer count to 132 at the end of q3, a 124% increase year over.

Our expanded footprint within the market is a reflection of our ability to both reach additional customers and grow existing relationships. In particular, we closed 273 deals this past quarter, representing an increase of 63% year over year. 19. Of those deals were at least 10 million in total contract value.

32 were at least 5,000,078. Were at least one. We have come as far as we have by consistently engaging with some of the hardest problems that the world and our customers have faced since our founding. For example, our work in supply chains, which is increasingly scaling into ecosystems, is powered by Foundry’s data integration capabilities.

This year alone, we have started 25 supply chain project. This includes the expansion of our work in ship building at Hyundai Heavy Industries, bringing the partnership to over 45 million, and the expansion of our work with the F D A to modernize food supply resilience to preclude shortages like the one we experienced with infant formula earlier this year.

The total value of contracts that we have closed in the third quarter reached 1.3 billion, A new milestone for us, which includes nearly a billion dollars of contract awards from the US government alone, such as our most recent contract worth up to 229 million with the US Army Research Lab to deliver AI ML capabilities across the D O D.

We recognize that our path to growth is not always linear, but with the opportunity that lies ahead, we continue to recruit and retain the top talent at a time when other companies in the technology sector are slashing their plans and cutting workforces. I’ll hand it over to Sham for further discussion regarding our business and product strategy moving forward.

Thanks, Ryan. We have spent the last two decades building our products for the world in which we actually live. The disruption and uncertainty that we’re seeing around us from Ukraine, the pandemic and inflation, it’s driving customers towards us and to our software. As the world continues to struggle with concurrent supply chain and energy crises, pound, your customers have been able to use Foundry to connect and integrate decision making within their value chain from their suppliers to their customers, to instantly trade off possible courses of.

You just saw highlights from two flagship events we held in Palo Alto in London. For our customers to share their experiences with each other, customers underscored the significant impact our software is having. Across industries. Executives at Tyson Foods shared how they generated 200 million of annualized savings in 24 months.

Jacob’s engineering shared how our software has reduced energy consumption by one fifth at its first wastewater plant running on Foundry with the potential to generate. 90 million of annualized savings across their 300 plants. Swiss Re shared that they saved more than a hundred million in the first year of use alone.

More than 35% of employees at Swiss re use our software on a regular basis. Our moment of macroeconomic uncertainty, that differentiation has never been more valuable to the market than today. These customers consistently focus on our ontology as the decisive factor in delivering results. Our strength, particularly in the US commercial market, has also received increasing recognition across the industry.

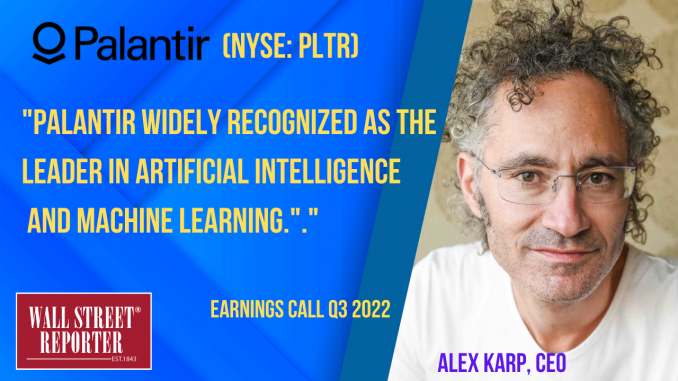

Gartner ranked us as a visionary in data integration. IDC ranked Palantir as the number one AI software platform worldwide by 2021, market share and sales beating Microsoft, ibm, Amazon, and Google. Forrester named Palant as the leader in artificial intelligence and machine learning. There is no place where time to kinetic impact is more important than on the battlefield.

In the government sector, Gotham has become the choice for us and allied defense organizations around the world. We have now officially received D O D I L six accreditation, a critical milestone for our broader government business, further enabling our SaaS offering on secret network. And our new Fed Start offering builds on Apollo to enable software companies to achieve FedRAMP authorization and record time and add a fraction of the cost.

In addition, we had our Titan vehicle on display at the annual A U S A conference where it was met with positive reactions from the US government partner nations, and the industrial base from the kill chain to the supply chain. Our products ensure that there are no missing links. I’ll turn it over to Dave to take us through the financial results from this.

Our US business continues to be the most significant driver of our growth. US revenue grew 31% year over year to 297 million, and on a trailing 12 month basis, US revenue grew to 1.11 billion. Our commercial revenue in the United States grew 53% year over year to 88 million. And our core US commercial revenue, which excludes our strategic investment program, grew 47% year over year and 7% sequentially US government revenue increased 23% year over year or two, 209 million on customer count.

Our net new US commercial customers grew 124% year over year and 11% quarter over quarter, marking seven consecutive quarters of sequential growth greater than 10. Turning to our global top line results. Third quarter total revenue grew 22% year over year to 478 million ahead of our prior guidance, even when factoring in an additional 1.4 million currency headwind since we issued guidance.

Overall net dollar attention was 119% remaining constant. Quarter over quarter. Commercial revenue increased 17% year over year to 204. Our international commercial business was roughly flat year over year and continues to be affected by both macroeconomic conditions and the strengthening dollar. A number of our customers in the United Kingdom, Europe and Asia enter into contracts denominated in US dollars, and as a result, the strong dollar has been a significant headwind for them.

Government revenue increased 26% year over year to 274 million. We saw our government business cross another major milestone this quarter as we generated 1.02 billion on a trailing 12 month basis, surpassing the billion dollar mark. For the first time. Our customer count continues to increase at a significant rate.

We added 33 net new customers in the third. Bring our Q3 2022 customer count to 337, a 66% increase year over year, and an 11% sequential increase. We added 25 net new commercial customers, which represents 98% growth year over year and 12% quarter over quarter. Our revenue within our existing customers also continues to expand.

Trailing 12 month revenue from our top 20 customers increased 15% year over year to 48 million per. Third quarter billings were 509 million, up 47% year over year. In the third quarter, total contract value or TCV was 1.3 billion US TCV booked was 1.1 billion, 90% of which was attributable to our US government business.

The third quarter TCV figure was driven significantly by renewals and expansions of existing US government contracts, a portion of which have already been funded. For total remaining deal value winded the third quarter with 4.1 billion. A 17% increase quarter over quarter. The quarter over quarter growth in total remaining deal value was driven by our unusually strong performance in tcv.

As I previously mentioned, the TCV of our US government contracts accounts for both funded an unfunded contract value, and we’re seeing this pass through to our total remaining deal. We saw headwinds to remaining deal value as a result of executing on our previously announced plan to cancel all remaining unfunded strategic investment commitments.

We ended the third quarter with 1.3 billion in remaining performance obligations of 43% year over year. As a reminder, RPO is primarily comprised of our commercial business as it does not take into account contracts with initial term of less than 12 months and contractual obligations that fall beyond termination for convenience clauses, both of which are common in our government business, turning to margins and expense adjusted gross margin, which excludes stock based compensation expense was 80.

Third quarter adjusted expenses were 397 million, up 9% sequentially. The sequential increase was driven primarily by headcount related expense as we had 450 net headcount editions in the quarter, our largest hiring quarter of the year, and including 141 new graduates who joined in quarter. Third quarter adjusted income from operations, excluding stock-based compensation and related employer payroll taxes was 81 million, representing an adjusted operating margin of 17%, 600 basis points ahead of our prior guidance.

Our adjusted operating margin significantly exceeded our guidance as a result of several factors, but primarily driven by cloud and deployment efficiencies, representing around 9 million about performance and the elimination of certain discretionary spend across the business, particularly in g a, representing approximately 14 million about performance.

We expect to continue to see efficiencies in the fourth quarter and will remain disciplined in our approach to discretionary spend in this macroeconomic. Third quarter adjusted earnings per share was 1 cent, which includes a negative 2 cent impact driven by losses on marketable securities. We generated 47 million in cash from operations, and our adjusted free cash flow was 37 million, representing a margin of 10% and 8% respectively.

This marks our eighth consecutive quarter of positive adjusted free cash. On a trailing 12 month basis, we generated 231 million in adjust every cash flow and 238 million in cash flow from operations. We ended the third quarter with 2.4 billion in cash and cash equivalents and no debt. We retain access to additional liquidity of up to 950 million through our 500 million revolving credit facility and 450 million delayed draw term loan facility, both of which remain entirely undrawn.

Our balance sheet leaves us well positioned to capitalize on opportunities that may arise in the current macro environment. Now turning to our. For the full year 2022, despite a negative 6 million currency impact since our prior quarters guidance, we are reaffirming our revenue guidance of between 1.9 and 1.902 billion.

Excluding such impact, we’d expect full year 2022 revenue of between 1.906 and 1.908 billion. We are raising our outlook for adjusted income from operations for the full year. We now expect adjusted income from operations of between 384 and 386 million for the fourth quarter after factoring in a negative 5 million currency impact.

Since our prior quarters guidance, we expect revenue of between 503 and 505 million. Excluding such impact, we would expect fourth quarter revenue of between 508 and 510. We expect adjusted income from operations of 78 to 80 million. With that, I’ll turn it over to Anna to start the q and a. Thanks, Dave.

We’ll begin with two questions from our shareholders before we open up the call. Our first question comes from Ryan who asks. Can you speak about the current competitive landscape and elaborate how Palantir products stand out against the newly launched Microsoft data platform, Salesforce Genie and the Snowflake platform that are attempting to offer an all-in-one solution like Foundry.

Time you wanna take this? Sure. Well, well, thanks Ryan. Uh, the answer is, is really the ontology. It’s why our platforms remain far ahead of the competition. And, and that’s because the ontology, it’s the missing link in terms of what you need to realize value from all of these investments. It’s the component in the architecture that’s required to.

get data apps to actually deliver value on top of cloud data warehouses or to get AI to scale throughout the enterprise or to turn your digital twin into something that’s actionable and operational within the enterprise. And we’ve spent 15 years investing in a roadmap that’s deep and and built upon the ontology.

And it continues to be the focus of all the core investments that we’re making around product. We’re deepening the capability that we’re offering our customers. And that’s happening against the backdrop where the competition has yet to understand what the ontology really is, but they will, and that, that’s really my main conclusion from our Foundry con events in Palo Alto and London, is that our customers were so clearly articulating the role of the ontology, the value they, they credited it as really the decisive factor in delivering results quickly.

And there are two things there that should not be taken for granted. Results that are quick. and, and so that, that’s I think a key focus here. You could, you heard from Deutsche Telecom, they talked about how they don’t even bother connecting to data sources. That won’t be modeled in the anthology because they see so much value in, in a reduced effort and increased outcome for the use cases that they’re able to build on top of the anthology.

We heard that from Rio Tinto, where they talked about at the Oyo Togo mine in Mongolia had they actually originally modeled risk in operations. , uh, but because they did the ontology it for free, they got an opportunity data set that helped them drive increased production, which is obviously the front end of, of the business there.

Uh, in Palo Alto, we heard it from Tyson’s Food where they were able to use the ontology to quickly go from an initial use case around Covid response to a set of use cases that got to 10 million of value, then quickly to 40 million, and then, then finally to $200 million worth of value. The, the, the, just a slightly different, uh, augmentation of what Sham was saying.

Um, Maybe a different riff, uh, that like underscores, you know, the success, uh, of people using our product is people think these products are easy to build. And by the way, and this is whether it was PG Nexus, pairing Gaia or Foundry, Foundry One, data integration Foundry two kind of ontology decisions driven.

You know, a lot of people even at big otherwise successful. Go from PowerPoint to thin technology under the assumption you can just take ontology, you can spell it slightly differently, you can spell it the same way and you can impose it on your honestly not very strong software offering that was last year’s technology with this year’s salespeople and it doesn’t work.

That’s why we are powering the US G. That is why we are powering war efforts. That’s. Uh, Foundry was used in, uh, it saved probably 500,000, uh, lives in America, mostly, uh, un uh, uh, people who are from the underclass and would’ve, would’ve died during Covid. Um, it’s, and, and it’s why the, uh, we need our competition to explain to the world, okay, you need this, but.

but they gravely underestimate the difficulty in doing this. We’ve been doing this for 15 years. There are thousands of hidden problems that really, I don’t think any other company understands, whether it’s the code chain, the supply chain, it’s like, and it, it’s wonderful that people are discovering this.

It’s going to take. Decades to build this stuff, even if you can build it as well as we can, you have to discover the problems. And that’s why our clients, you know, on the Evangelism tour, primarily in the US are galvanizing the market and leading to these results. Um, but, but the difficulty is just completely underestimated.

Thank you, shaman. Alex, our next question comes from Grav who asks, what are Palantir’s plans to grow the business in this challenging macro environment? I mean, uh, uh, other people should have, we’ve, we, we’ve been predicting a even more challenging macro environment than this for the last 20 years. I mean, how long have we been in the trenches together?

Uh, 17. Yeah, 17 years in the trenches. Um, the products are built for a disjointed. A world where you need horizontal and vertical integration, where you in the military context, or actually we have low latency where your systems, underlying systems actually don’t work, even though in the PowerPoint they say they do, uh, where you have to deliver results overnight where your business totally effed and you gotta make it work in a quarter.

That, that’s what our business is built for by the way. That’s why we, we prepared, and then that’s the technical thing. Why do we have eight quarters of free cash flow? You think it’s a coincidence. We were preparing for this. We have, why do we have 2.4 billion on the bank and no debt? We weren’t living in the metasphere.

We were living in this world in the way we thought it would be. And we, we’ve been essentially, you could even look at us as a prep. We’re a prepper company. We’ve been preparing, it’s like instrument preppers have their ruck sack and the rifle. We have pg Gaia foundry and 2.4 billion in the bank, and no debt.

That’s our company. Thanks, Alex. Our next question is from Brent with Jeffries. Brent, please turn on your camera and then you’ll receive a prompt to unmute. Good morning, uh, Dr. Carp on the government business. At the beginning of the year, you had a, a bigger aspiration, uh, for deals to come into the, the pipeline.

I think you, you brought, uh, a closed assumption down. I’m, I’m curious, uh, where you, you see the pipeline of the government transactions for the back half of this year into, into 23? Um, it was a little bit, um, okay. The breaking up, but I think you were saying where do we see the government revenue going?

Look, we’re, we are positing to the world purely financially. Balance years had a CAGR of 35% in the u sg, it’s that kegers includes years, I think three years that were flat. So we tend to have kind of lumpy growth and flatness, which no one likes. You don’t like it. We don’t like it. We’re positing that the future will look more like the traditional baseline of 35% than the baseline of this year.

Of what? In up upper. , what is the proof of that? Okay. I could tell you how our products are being used on the front line. You can read the news, you can probably surmise at things like Nexus peering, uh, Foundry Gaia, our, our, our powering events that you may be reading about. And then there’s our massive tcv.

It’s like, it’s like, yeah, TCV in the sg just under billion dollars. This is. Um, we, there’s a legitimate question. When do you capture that in the form of gap revenue? That’s a legitimate question to which we have no answer, but we will capture it. We will capture it because the, the, the contracts have been concluded and because we are sitting on the most important missions in the world, uh, and those missions are going to end up being fully funded, and you see that in our contractual relationships.

Thanks, Alex. Our next question is for Mariana with Bank of America. Mariana, please turn on your camera and then you’ll receive a prompt to unmute your line. Morning everyone, by the way, so my question is, we don’t see you, not that that’s inherently . Uh, I don’t know how to fix that final, I’ll go ahead with a question.

Okay. So with increased expectations for globalization next. . I understand it’s probably too early to discuss specifics about 20 20, 23 outlook, but would you mind discussing how you’re thinking about the positive and negative catalyst from a global recession or a potential recession? Because the thing I, the way I think about it is it’s a positive catalyst for disruption and increased needs for operational efficiencies and for volunteer demand, but, Probably lower corporate profits are a challenge.

So how are you thinking about that? Um, the, the, we disambiguate the world into America, Canada, uk and then what it, what is, what has historically been a very large market for us, uh, Europe, driven by Germany. What I think you see happening is that disruption is helping us in the. , it’s driving results that are outsized in US commercial.

Our LTM in the last 12 months is, you know, 327 million, roughly 102% growth. Um, you see the TCV number in U S G, you can surmise what that means. . So, and then the positive side of it is that, you know, the integral of US revenue for us is growing at 61%. It used to be 41, 40 9% two years ago. It will be in the 70% range fairly shortly.

And so the, the impact of the disruption is much greater and the di slash the disruptive negative effect of Europe, especially sluggishness in in Europe’s motor. Will impact us less. However, what I believe and other people should talk about is that we are going to see negative impacts because of strong dollar, because of slugged to adopt new technologies in Europe that will impact our business is impacting our business.

If you took those results, the LTM for, uh, for, for our gloat, for our US businesses still just under 40. . And so if you took out our European market, this would be, I mean obviously the results are strong, but they would, we’d be flying in like a, you know, so, um, and those are gonna impinge us. They’re gonna continue to impinge us.

It’s just the amount of impingement’s gonna be less. I do think it’s particularly dangerous for most people in tech. , this environment is a not in an environment where flimsy, thin, non valuable. Essentially you churn your data and you show our PowerPoint to somebody who barely understands that technology is going to work just cuz you’ve got a great steak dinner and white teeth, that’s not gonna work.

And Americans still expect a lot more than that, both in government and in commercial. Uh, now the rest of the world may not expect more than that and that that’s a problem for the rest of the world, long term and a problem for us in the near term. But, um, but yeah, we see this as a, a huge opportunity. Uh, both because yeah, other people will fail and will succeed.

I don’t know what, what do, look, I, yeah. Disruption has always been a huge opportunity for us, and I think that’s exactly right, and those, those geographies are where we’re focused. Thank you, shaman. Alex, our next question is from Gabriela with Goldman Sachs. Gabriela, please turn on your camera and then you’ll receive a prompt to unmute.

Hi. Good morning. Thank you. We appreciated the case studies at Foundry Con about the tens of millions of savings that some of your customers are realizing. So there’s two questions on my end. One is, how are you thinking about evolving the pricing model towards value-based pricing? And give us an update on how you’re thinking about capturing the upside from value-based pricing while also giving a customer flexibility with their initial price points.

And then the second question is, For deployed engineering model, how is that evolving as you start finding lower customer, lower commercial value customers on the ACV side? Does that essentially shift your mix away from the Ford deployed engineering model over time? Something else wanna. Forward. Yeah. So on the pricing side, I mean, value-based pricing is where we started.

That’s, that’s kind of our, our, our jam, so to speak. And I think what we’ve had to evolve over time is pricing models like usage-based pricing that enable enterprise customers to start on smaller use cases, nibble into it, kind of figure out where it’s gonna fit in their enterprise, come experientially to realize the, the power that the ontology unlocks, and then scale that across their operations.

And you can kind of see. Playing out in the case studies where, you know, Tyson starts with covid response and then scales to, you know, sn o p plus plus plus, you know, so like from a small use case to the breadth of the enterprise here. And that’s, that’s been very helpful for us. And then we have customers who kind of migrate models from usage based to.

Large enterprise contracts as they go. And I think really for us it’s been showing the flexibility to meet the customer where they’re at. In terms of our four deployed engineering models, like our, I, I really think about that as much more in terms of r and d from our shoes. Like, you know, how many people are spending time at the coal phase asking the hard question of, is my software working?

And I don’t mean, does it work as in like, is there an oom, is there a bug? I mean like, does it effing matter to this institu? and in this time of immense macro economic challenge, like, am I saving the institution? Am I doing anything that’s gonna move the needle or is my little churning the data, just moving deck tears on the Titanic?

And those are the people who actually have that sensibility, and they’re the ones who come up with the ideas of what are we gonna build next? What can we do now? How do we inflect the product roadmap so it matters? Uh, and so we’re always gonna modulate how we deploy those folks between U S G. Things that are happening in Europe, uh, things that are happening at the front lines of our customers operations, the engineers looking and seeing what we’re doing on, uh, in, in large scale mining operations in Mongolia as it relates to driving our r and d roadmap forward.

Thanks Shum. Alex, we had a lot of individual investors on the line who submitted questions. Is there anything you’d like to say before we end the call? You know, um, Um, we built this company for, uh, really tough times. The times are tough and they’re gonna get worse. Um, we feel that Palantir, we know Palantir shines, whether it’s in the anti terror context, the war context, the Covid context for the US commercial context, when times are bad, um, uh, that this is a long term play.

we are watching the, our products and how they’re absorbed in the market. Um, and, uh, um, and I really appreciate your support. Um, you know, our individual investors mean a lot to us and to me. Um, and, uh, we are planning to continue to like, go into battle every day. Um, we are living in this world, not in some meta fake.

that you know you may enjoy until you wake up and you are poorer. Your brain works less well and you hate your neighbor. Uh, uh, we, we are, you know, those size and depth and quality of our revenues matter to us and to you. Um, we believe we are making the west a stronger and better country. Uh, we see in America an ability to adapt like no other country, uh, to.

Open to people who, uh, present things in the ways that look batshit crazy. And if they work, they don’t really care, and they give you an ability to buy in. We celebrate that. We, we are enormously proud of our work, uh, defending the West, especially the US military and its allies. I wish I could tell you more about what we’re doing and how much it’s transforming the world to be a better place.

How much it scares our adversaries. What we deliver scares our advers. How much we were underestimated by our adversaries because of the informational technology and products we’ve built over decades of the quality of the people we have here, the pain we go through to deliver and our commitment to win.

Thank you, Alex. That concludes today’s call.